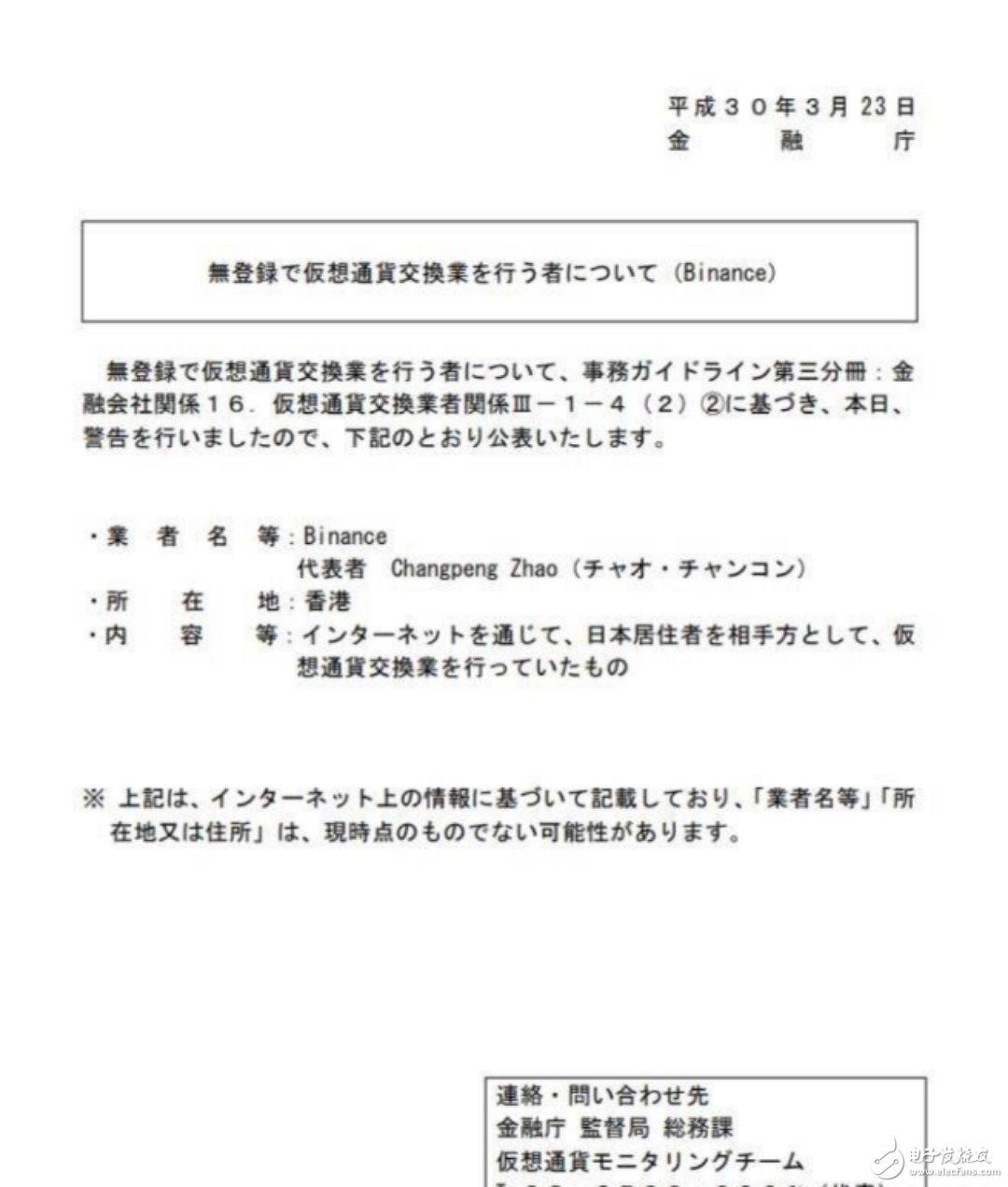

According to reports, today, Japan JFSA (Japan Financial Services Agency) officially issued a warning letter to the currency, saying that it did business in Japan without the registration of the Financial Services Agency, the Financial Services Agency believes that it can not protect users. If you do not stop trading in Japan, you will consider filing a criminal charge against the police.

According to Japanese media, the purpose of the Financial Services Agency is to create a sound trading environment for virtual currency. The warning is to expose illegal activities in the surveillance of unregistered companies, thus creating a healthy trading environment.

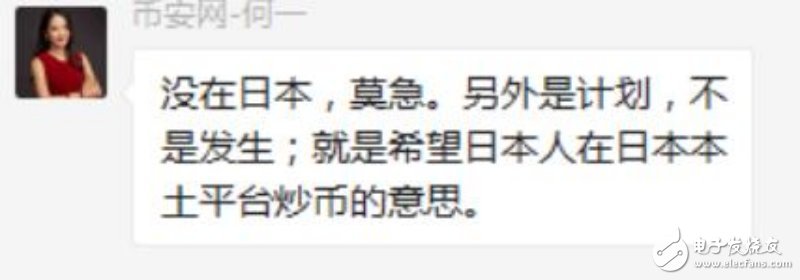

In response, Zhao Changpeng, the founder of the currency, responded on Twitter that the company lawyer immediately communicated with JFSA after receiving the warning letter and will find a solution. As a COO of the currency security, He Yi also responded on the social platform that he did not open a branch in Japan. The so-called prohibition is only a plan that has not been implemented.

The currency security was a relatively late start in the domestic virtual currency exchange. However, due to the early sea and the domestic fight against ICO, the currency security from the second-rate trading platform became the slogan of the blockchain project team.

It is rumored that because ICO is banned, exchanges, especially overseas exchanges, have become a must-have resource for money-issuing projects. Exchanges, including fire coins and currency security, have started paying for the currency. HADAX of the fire coin was also criticized, but He Yi said in the “3 o'clock†blockchain community that the coin has its own audit team, and the audit mechanism is strictly strict, and Zhao Changpeng cannot intervene.

Regardless of whether there is a paid currency, the virtual currency exchange has undoubtedly become the most beautiful bird in the chain and the currency circle. However, the old saying of shooting a bird is still somewhat reasonable.

Of course, at present, the domestic policy on the virtual currency exchange has not been introduced. The so-called rumor of completely blocking the domestic users’ overseas trading of virtual currency has also been thought that Xuanzhi and Xuan have not come true. However, this does not mean that exchanges like Fire Coin can sit back and relax.

At the beginning of March, the currency security suspected of being hacked. A large number of accounts began to sell virtual currency other than bitcoin, and bought a lot of bitcoin. Later, they purchased Viacoins tokens, causing the currency price to rise rapidly in a short period of time. The currency security response was timely and the loss was saved by the rollback transaction.

However, there are remarks that the invasion was not directed at the currency security or as Coincheck was purely for theft of tokens, but rather influenced the entire virtual currency market through the influence of the currency security, thereby drawing greater benefits. This time, the black currency has blocked the domestic users, long-term maintenance and the warning of the JFSA against the currency. An exchange has caused many market declines in the entire virtual currency market.

In addition to hacking, the currency that has not been flat after the Spring Festival has been squandered by the younger generation, and the way is to use the name of Tencent engineers to "declare war" to the currency security, which is huge and onlookers. In the end, the Weibo account was blocked, and the previously announced address was also found to have transferred more than a dozen ETHs.

Although there was no upset of the waves, it was just after the invasion of the currency security, even if there was a “hacker reward order†in front of the currency, it still could not stop the doubts about the security of the trading platform.

It is ironic to look at the development of decentralized technology in a highly centralized way.

However, in the view of some industry insiders, the technology of currency and blockchain is inseparable. The research and development of technology requires financing. A reasonable ICO is helpful to the development of the project team. The problem is that data from survey agency 451 Research shows that only 1% of the 600 companies surveyed have developed blockchain-based applications.

Think about ARTS, space chain, hero chain and other projects. This market needs a lot of local norms. The “DAICO†re-introduced by V God does not know whether it can maintain the fragile “consensus†between investors and project teams, but now it is virtual. The currency market seems to be heading towards the future of "90% return to zero" predicted by V God. The current currency circle and chain circle need to be falsified, and on the other hand, it is a high talk of "3 o'clock". It is a blockchain mobile phone that Lenovo and Changhong don't know. Who is pushing the technology forward, who is in trouble?

CIXI LANGUANG PHOTOELECTRIC TECHNOLOGY CO..LTD , https://www.cxblueray.com