On September 26, Hongli Zhihui (300219) announced that the company intends to acquire a 56% stake in Yishan Auto Lamp held by Zebo Partners with self-raised funds of RMB 21,963 million. After the completion of the transaction, the company holds the friendship. Good car lights 56% equity.

Since its inception, Hongli Zhihui has been engaged in white LED packaging for lighting applications. At the same time, it has actively extended to the downstream of the industrial chain. In 2007, Guangzhou Foda Signal Equipment Co., Ltd. was established, mainly engaged in the research and development of commercial vehicle LED automotive lighting products. Production and sales, the products are mainly sold to overseas markets.

In recent years, Hongli Zhihui has used its own advantages in the LED industry chain to actively lay out the LED vehicle lighting field for passenger cars. The acquisition of part of the equity of Danyang Yishan is its further layout in this field.

Danyang Yishan Auto Lamp Equipment Manufacturing Co., Ltd. was established in 2003, mainly engaged in the production of vehicle lighting manufacturing equipment, vehicle lamps and plastic parts; processing vehicle lighting parts; development and design of molds; electronically controlled fuel injection system, general cargo road transportation, from Ying and agent import and export business of various commodities and technologies. The main business is the design, development, production and sales of automobile lights. The main products include front combination lights, rear combination lights, front and rear fog lights, high position brake lights, etc. Currently, the main supporting car manufacturers include Geely Automobile and Changan. Cars, Great Wall Motors, Zotye Motors, Changfeng Cheetahs, etc.

Before the completion of this transaction, the equity structure of Yishan Auto Lamp is as follows:

Note: Zebo Partnership directly holds 72.59% equity of Yishan Car Light, which is the controlling shareholder of Yishan Car Light; Guo Zhiqiang directly holds 27.41% equity of Yishan Car Light, and indirectly holds Yishang Car Light through Zebo Partner 43.55% of the shares, directly and in conjunction with the holding of 70.96% equity of Yishan headlights, is the actual controller of Yishan headlights.

After the equity transfer, the equity structure of Yishan Auto Lamp is as follows:

Hongli Zhihui said that this investment is to better utilize the company's advantages in the LED industry chain, accelerate the realization of the company's layout in the field of passenger car LED automotive lighting, and actively and effectively cut into the domestic passenger car LED lighting vehicle The supply market can further enhance the company's overall competitiveness and achieve sustainable and healthy development of the company.

On the same day, Hongli Zhihui also issued a notice on the transfer of equity in the participating subsidiaries. After careful research and decision by the management of the company, it plans not to increase investment in Hezhong Automobile. Up to now, the company holds 4.82% equity of Hezhong Automobile. Guangzhou Hongyi Investment Co., Ltd. (hereinafter referred to as “Hongyi Investmentâ€), a wholly-owned subsidiary of the company, holds 7.23% equity of Hezhong Automobile, and the company directly and inter-connected Hecheng Automobile has a 12.05% stake.

Honglizhihui said that under the premise of maintaining the company's overall strategic layout, in order to increase the company's cash flow and enhance the company's continued profitability, the company plans to hold 4.82% of Hezhong Automobile (corresponding to the capital contribution of 20 million yuan). The equity was transferred to Fang Yunzhou for RMB 80 million. The transfer will have a positive impact on the company's future financial status and operating results. At the same time, it will help the company to fully utilize resources and enhance and realize the healthy and stable development of the main business. The company's long-term development plan. After the completion of the transfer, the company held a 7.23% stake in Hezhong Automobile through its subsidiary Hongyi Investment and no longer directly holds the equity of Hezhong Automobile.

According to the announcement, the business scope of Hezhong Automobile includes: design, development, production, sales and related consulting services for new energy vehicles and parts; computer software development; industrial design of new energy vehicles.

With the intensified competition in the LED industry, in order to continue to maintain the company's core competitiveness and sustainable development, in recent years, Hongli Zhihui actively builds the LED+ vehicle network dual main business layout, and has carried out a series of resource integration around this strategy, and achieved good results. The effectiveness.

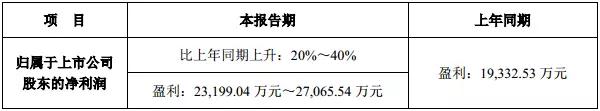

Judging from the results of the first three quarters of 2017 announced by Hongli Zhihui on the 25th, from January 1, 2017 to September 30, 2017, the company realized the net profit attributable to shareholders of the listed company: 231,900,400. Yuan-27,65.54 million yuan, up from the same period of last year: 20%-40%.

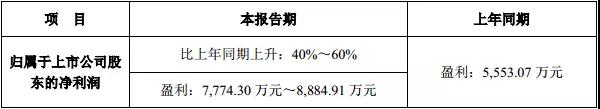

Among them, in the third quarter of 2017 (July 1, 2017 - September 30, 2017), the net profit attributable to shareholders of listed companies was: 77.73 million yuan - 88,849,100 yuan, up from the same period of last year. : 40% - 60%.

Hongli Zhihui said that the main reasons for the changes in the first three quarters were: 1. During the reporting period, the LED lighting market needs to be better, the company's operating performance remained stable, and the sales revenue achieved steady growth; 2. The acquired subsidiary company, Quick Easy Network 6 The month began to be included in the consolidated statement, and operating results increased.

With the development of the times, the consumption level of people is gradually increasing. At the same time, people's entertainment methods are beginning to diversify, especially for modern young people. As a result, different kinds of electronic products are starting to be in people's lives, and the booming Electronic Cigarette industry reflects this.

Described including the upper shell, the upper shell at the top of the smoke outlet, as described in the bottom of the upper shell with airway, described with the smoke outlet in the airway and also to match the upper shell, the lower part of the shell described the airway in the direction of the lower shell extension, as described in the lower shell near one end of the upper shell is equipped with oil mouth, described the lower shell with batteries, described at the bottom of the bottom shell has come in The air port is provided with an oil storage bin in the lower shell, and the air passage passes through the oil storage bin and is provided with a heating atomization bin at one end away from the smoke outlet. The utility model has beneficial effects: it can meet the smoking habit of different users, avoid the premature end of the use experience caused by excessive consumption of smoke oil, and indirectly prolong the service time and life of the product.

Refillable E-Cig Oem,Refillable Vape Pod,Refillable Vape Pen Oem,Refillable Mod Oem

Shenzhen MASON VAP Technology Co., Ltd. , https://www.masonvap.com