This article will then future trends, the core components of a re-sort of things from the industrial chain to manufacturers - wireless communication module.

Recently, a 500,000-piece "universal standard" bidding result was released, which triggered a hot debate in the industry. As a core component of the terminal accessing the Internet of Things, the wireless communication module is rarely mentioned in the industry. Today, three reports are integrated to talk about the industry.

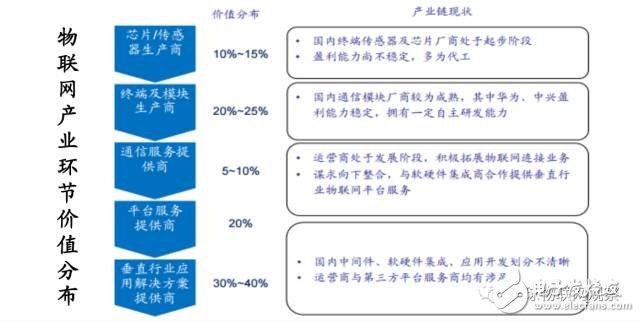

Industry chain analysis

The wireless communication module is a key link connecting the Internet of Things perception layer and the network layer. It belongs to the underlying hardware link and has irreplaceability. There is a one-to-one correspondence between the wireless communication module and the Internet of Things terminal.

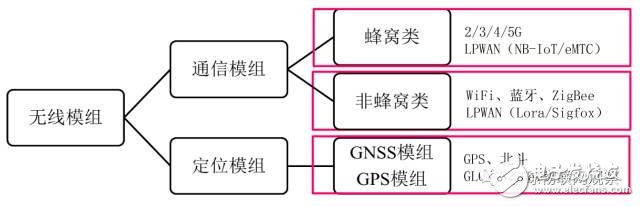

Wireless module classification

The wireless module is divided into "communication module" and "positioning module" according to functions . Relatively speaking, the communication module has a wider application range, because not all Internet of Things terminals need to have a positioning function.

Note: Due to the introduction of short-range wireless communication chips, this paper mainly uses cellular network modules (2G/3G/4G/ NB-IOT).

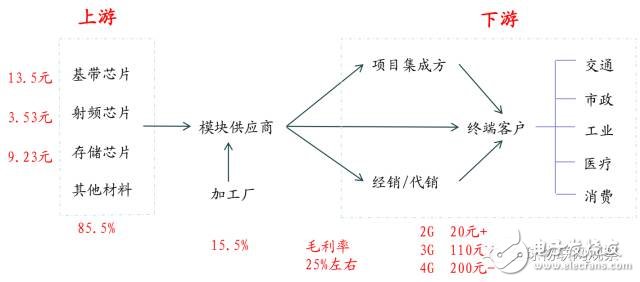

From the perspective of the industrial chain, the upstream of the wireless communication module is the production raw materials such as baseband chips, and the degree of standardization is relatively high. Downstream is the subdivision application field, which is extremely scattered, and often flows to various fields through the intermediate distribution and sales agency. The module company's model is generally: self-purchasing upstream materials, and responsible for product design and sales, production is outsourced to third-party processing plants.

In the upstream, the baseband chip (communication chip) is the core, accounting for about 50% of the material cost. The upstream technical barriers are high, the industry is highly concentrated, and the suppliers have strong voices. Major suppliers include Qualcomm, Intel, MediaTek, Rideco, Huawei, and ZTE.

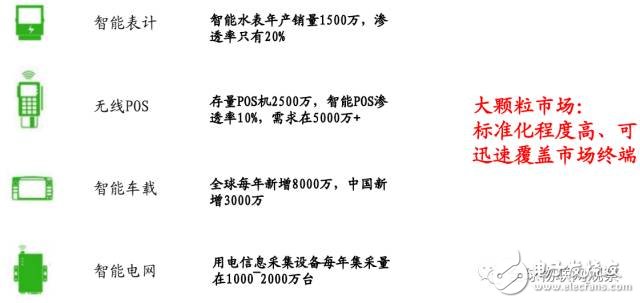

Due to the wide range of applications for the Internet of Things, the downstream of the industry is very fragmented. According to the size of the application market, it is divided into large particle market and small particle market. The large particle market (see the figure below) has a large amount of IoT modules, high degree of standardization, and fierce competition. It is suitable for making large revenues and establishing brands. R&D personnel can be relatively small, but market development capabilities are strong.

The small particle market (such as industrial Internet of Things, asset tracking, environmental monitoring, etc.) has a small amount of IoT modules, a high degree of customization, and a high level of gross profit margin, but it has high requirements for supplier R&D investment.

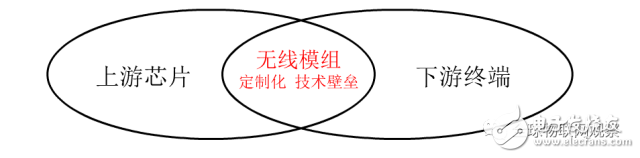

The IoT module itself is in the middle of the upstream standardized chip and the downstream decentralized vertical field, and needs to meet the specific needs of different customers and different application scenarios. Its hardware structure design and customized software development have become the link of added value and the value of the industry chain.

Industry chain value:

1. Hardware integration and design, combining multiple communication systems to meet the environmental requirements in different application scenarios, stability and timeliness are the core;

2. Customized embedded software development, burning Linux/Andorid system to meet different downstream application requirements, mature application experience and solution capability is the core.

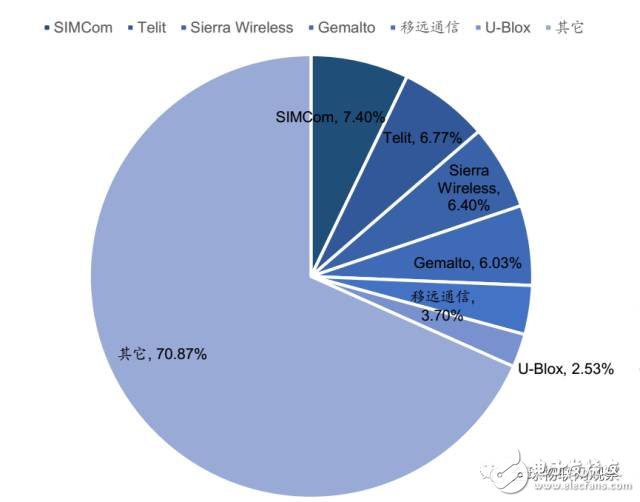

In the wireless communication module market , the current concentration is not high, and the industry's first echelon only accounts for about 30% of the global market share. With the rise of downstream applications and the expansion of the total market size, a number of high-quality module suppliers focusing on individual vertical applications will begin to emerge.

Global module supplier market share in 2015

Source: Guosen Securities Economic Research Institute

Overall, the industry is currently in the first echelon to lead the market, the domestic second echelon is gradually growing competitive landscape. Leading global companies include Telit in Italy, Sierra Wireless in Canada, u-blox in Switzerland and Gemalto in the Netherlands.

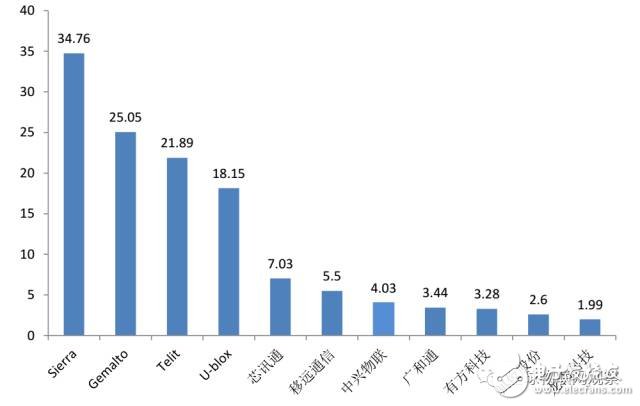

2016 industry company module income list (100 million yuan)

"War-related" enterprises

In the past year, the domestic first echelon wireless communication module suppliers have landed A shares in IPO or mergers and acquisitions. The following are the main “market-related†enterprises. ( Note: the ranking is in no particular order )

1, core communication

Headquarters: Shanghai

Introduction: Simcom is a subsidiary of Hong Kong-listed company Chenxun Technology, and its products account for a large proportion in the smart POS, smart meter reading and health care industries. Because the wireless communication module business of Corecom is a relatively traditional manufacturing business, it is inconsistent with the strategic direction of the overall transition to the high-margin service industry.

In January of this year, Chenxun Technology planned to sell the wireless communication module assets (a wholly-owned subsidiary Shanghai Ximtong and Corecom Wireless) to Swiss u-blox for US$52.5 million. It is estimated that this acquisition did not reach a consensus because of the disruption of communication in Shanghai. Chenxun Technology finally announced that it would sell the company to the company that moved to the son of communications and internal directors, and at the same time, it will have another asset. Electronics are also packaged for sale.

According to the latest announcement of the move to communication, the Shenzhen Stock Exchange is still reviewing the transaction plan.

Official website:

2, moved to communication

Headquarters: Shanghai

Introduction: Mobile Communications was established in 2009. The products are mainly based on positioning modules and were listed on the IPO in January 2017. Upstairs core communications wireless cable module shipments climbed to the top in the world in 2015, if the acquisition is successful, then move to communication will become the world's largest Internet of Things wireless communications company, laying its Internet of Things communication Monopoly position in the terminal field.

Official website:

3. Remote communication

Headquarters: Shanghai

Introduction: Mobile Communication was established in 2010 and has grown rapidly. Its products have gained a lot in the domestic smart POS market, overseas automobile front-loading market and operator market. Leading the layout in the field of NB-IOT modules, it is one of Huawei's early NB-IOT chip supporting production partners. Zhaoyuan Communications was listed on the New Third Board. At present, Zhaoyuan Communications has planned to list in the A-share market and has submitted relevant information to the Shanghai Regulatory Authority.

In this gossip, Liao Ronghua, the founder of Shiwei, and Qian Penghe, the founder of Shiyuan, are all from Core Communication. Moved to and moved away from the early years, this is a family (shifted to), and then they are independent due to the differentiation of business development direction.

Official website:

4, high emerging

Headquarters: Guangzhou

Introduction: Gao Xinxing is a smart city IoT application and service provider. In 2016, it acquired ZTE Corporation, a subsidiary of ZTE's wireless communication module. Zhongxing IOT focuses on the enterprise-level market and has accumulated a lot in the application of car networking and satellite communications.

Official website:

5, Guanghetong

Headquarters: Shenzhen

Introduction: Guanghetong was established in 1999 and is an established company. In the early days, Motorola OEM, in 2008, Telit acquired Motorola's mobile communications department, and the contract signed with Guanghetong was completely void. After that, he transformed himself into a private brand. After receiving Intel investment, he successfully entered the high-margin notebook computer, PAD and other electronic consumer markets. In April of this year, Guanghetong successfully listed.

Official website:

6. Yu Jun shares

Headquarters: Xiamen

Introduction: Qi Jun Co., Ltd. was established in 2012. In 2013, it obtained the production qualification of the live satellite set-top box positioning module identified by Radio and Television. It was applied by nearly 30 enterprises including Haier, Hisense, Changhong, TCL and Konka, and seized the position of domestic set-top box. Most market share in the end market.

Official website:

7. Japan Shipping News

Headquarters: Shenzhen

Introduction: Rihai Communication is the largest supplier of physical connection equipment for communication networks in China. In September, Rihai acquired Longgang Technology, the leader of 4G wireless communication module, and the previous investment of Ayla Realm to realize the Internet of Things cloud platform. + The layout of the module, while providing the cloud platform for the traditional enterprise, it can also directly package the module to realize the integrated sales of the product.

Official website:

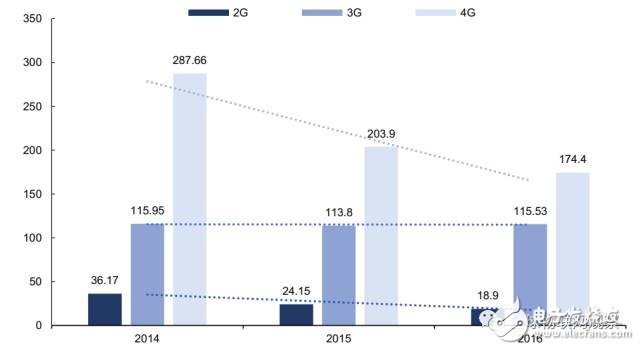

Future trend

For Internet of Things terminals to achieve networking or location functions, wireless modules are required. Usually, for each additional terminal, you need to add 1-2 wireless modules. The market is big and needless to say. Of course, this is the future direction. From a short-term perspective, the price of 4G modules is rapidly declining, and shipments will have a large increase.

Guanghetong 2G/3G/4G module price trend

At present, domestic wireless communication module suppliers are more focused on the module business itself. However, the simple module business is highly standardized, the price is transparent, and the premium space is not large. International leading enterprises have begun to explore new directions in the development of module business, which is worth learning from later.

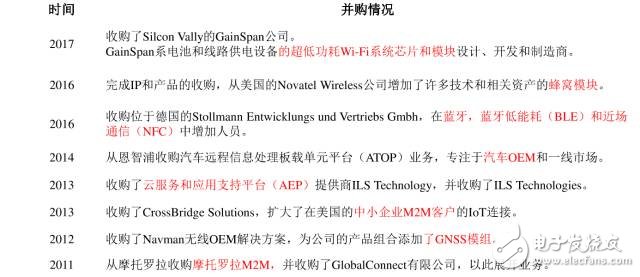

Founded in 1993, Sierra Wireless Canada is the world's first provider of cellular communication modules, with full-product line supply capabilities such as 2G, 3G, 4G, LPWA modules, Bluetooth, WiFi, and GNSS. The module business has become a well-deserved industry leader.

In order to improve the overall business profitability and open up the company's growth space, Sierra Wireless has built a one-stop solution service of “end+cloud+application†through self-development + mergers and acquisitions.

A list of Sierra's recent mergers and acquisitions

Based on the hardware business (module), the company launched the AirVantage Cloud cloud platform. In 2014, the company launched the Linux-based open source embedded platform LegatoTM. In 2015, it introduced the open source hardware design project MangOH, based on these two service platforms and the AirVantage cloud. Platform, the company can provide complete IoT platform service capabilities.

In conjunction with the communications module, Sierra Wireless offers a range of intelligent routers and gateways, as well as management tools and applications to provide cellular connectivity services based on customer specific requirements, while all cellular gateways can be remotely monitored, managed and controlled via the AirVantage Cloud platform.

In the specific vertical application field, the company acquired GenX into the car networking market in 2016, completing the full-service extension of the “end+cloud+application†solution.

Sierra Business Layout

What is the result of the transformation? From the perspective of Sierra Wireless's financial report, the introduction of the Internet of Things platform has led to a steady increase in gross profit margin. The company believes that the platform business will occupy an important position in the future. It is expected to contribute about 70% of revenue in 2021.

From the industry chain to the manufacturers to the future trends, I believe that you have a comprehensive understanding of the wireless communication module industry.

Note: Relevant sources of this article

1.07-20 Guoxin Communication--《The Internet of Things Talks 2: Sharing Communication Modules in Bicycles》

2.08-29 CITIC Construction Investment--"The Internet of Things Deep Report Series 5: Wireless Modules, Allowing Everything to Be Networked and Positionable"

3.09-22 Guosen Securities--《Research and Reflection on Wireless Communication Module Industry》

The important data sources for this article are the following three articles:

1, 09-22 Guosen Securities "Wireless Communication Module Industry Research and Thinking"

2, 08-29 CITIC Construction Investment "Networking Depth Report Series 5: Wireless Module, so that everything can be networked, can be positioned"

3, 07-20 Guoxin Communication "Internet of Things talks about the second: sharing the communication module in the bicycle" Thanks to the original author's dedication!

5.08MM Power+ Signal Power Connector

2.54MM Pitch Signal Power Connector.Chip power connector is used in power module system. It can select the matching power + signal connector according to the need. The feature is that the number of power and signal contacts and the matching sequence can be selected arbitrarily while keeping the connector size and contact core number unchanged.

Plug (male) / socket (female) can be installed at 90 or 180 degrees. It supports mixed or independent combination of signal and power. The quantity range of power and signal is (2-16) pin and (12-128) pin respectively

Product features

High temperature resistant, glass fiber reinforced and flame retardant polyester is used as insulation material

Copper gold composite conductor with high conductivity is used, and the contact area of the conductor is plated with gold

It adopts shrapnel contact, which has the characteristics of integration, small volume, large current carrying capacity, soft plug-in, blind plug-in, self guidance and high dynamic contact reliability. This series of products can be interchanged with FCI's powerblade series and Tyco's multi-beam series

The length of power hole / signal pin can be selected in two sizes. The power rated current is 45A and the signal rated current is 2.5A

5.08MM Power+ Signal Power Connector

ShenZhen Antenk Electronics Co,Ltd , https://www.atkconnectors.com