It is already a trend for domestic companies to acquire oil and gas blocks overseas.

Guanghui Energy, MI Energy in Kazakhstan, Hemer Technology, Midea Holdings in the United States, and United Energy in Pakistan... There is a plate in the domestic listed companies, mainly such companies that obtain oil and gas resources overseas.

However, there are very few oil companies that are truly focused. When reporters visited this oil company office, which already had 14 blocks of overseas oil companies, curiosity became worse: how could they do it? What ideas and plans do they have for mixed domestic ownership?

Private Oil Overseas Experience

The oil company that this newspaper reporter is curious about is Asia-Pacific Petroleum Corporation (hereinafter referred to as “Asia-Pacific Oilâ€), an oil company that is a traditional household appliance giant TCL Holdings. It was established in August 2010, and it acquired a block in Argentina at the end of the year. Four years later, Asia Pacific Petroleum has acquired 13 blocks in Argentina and one block in Indonesia. Zhang Jun, President of Asia-Pacific Petroleum, told the reporter of the First Financial Daily that “at the end of the year there will be 20 blocks.â€

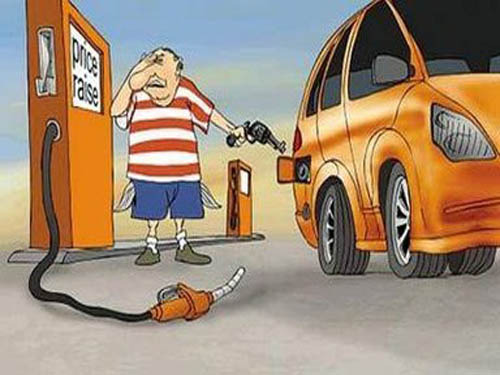

Because the domestic oil and gas upstream sector is closed, private oil companies and state-owned oil companies that have entered the country have no chance, and they can only go abroad to obtain resources. Foreign risks are also high.

Recent purges by PetroChina overseas companies have also gradually attracted everyone’s attention to overseas oil investments.

PetroChina, Sinopec and CNOOC are the protagonists of international mergers and acquisitions in previous years. However, affected by the corruption of the energy system, Chinese companies have not had major mergers and acquisitions so far this year.

Compared to national oil companies, private oil companies are much more flexible. Zhang Jun explained that privately-owned oil companies have a small amount of funds and they will be cautious when selecting blocks. Moreover, investment is its own, and it will be counted as particularly clear, and it will not be easy to get rid of it because of its poor efficiency and poor resources, and its ability to control risk is stronger.

Privately-owned oil companies also have the advantage of flexible mechanisms. Compared to Chinese state-owned oil companies, private oil companies can buy and sell blocks, and they can stay on their own for development. Unsuitable ones can be sold, and state-owned oil companies can only buy. Sell ​​less.

The risk of overseas oil investment is also reflected in politics, policies, economics, and finance. Zhang Jun believes that when companies choose overseas investment destinations, they first consider that there is no war, and countries with political opposition are generally afraid to get involved. Second, it has an in-depth understanding of the country’s environment. Then it is also particularly concerned about the way of contracting in various places. The 100% equity mineral tax contract is the best, and other yield sharing and technology increase contracts will affect the yield.

Based on this, Asia-Pacific Petroleum is deepening Argentina, with a total of 13 blocks in Argentina. Half of them are exploration blocks and half are development blocks. Overall, it has not yet entered the production chain and currently generates $20 million in revenue each year.

At the same time, Argentina’s current economic situation is not good, and domestic private oil companies have lagged behind in the development of technology. Zhang Jun believes that with the expected changes in China's oil and gas policy and policies that encourage foreign investors to participate, the situation will become better and better, and now is a good time to purchase assets.

For the Indonesian block, it is mainly because of the technology increase service contract, that is, after the investment recovery, only 26% of the profit can be obtained. Therefore, Asia-Pacific Petroleum is only acquiring blocks near mature oil fields to test the market.

Hope to enter the domestic oil and gas industry

Since the beginning of this year, the domestic investment in exploration has been drastically reduced, and the days of the domestic oil and clothing industry have generally not been good. Before the industry insiders suggested that Chinese companies should compete on the international stage. However, as far as the current situation is concerned, Chinese oil companies and oil service companies that have truly succeeded in the international market are rare.

“As a Chinese company, we very much hope to obtain a base in the country, even if it is a low grade oilfield.†When talking about the opening prospects of the domestic oil and gas sector, Zhang Jun told reporters, “Flies are also meat, but better than nothing. ."

However, for the moment, Zhang Jun believes that domestic mixed ownership does not have an effective way to participate, and the upper reaches are relatively closed. China's lack of oil and gas resources depends heavily on imports. Private enterprises have advantages and should promote marketization.

Zhang Jun said that the government also considers that private enterprises will disrupt mining as they enter the upper reaches. However, the government should do government affairs, formulate policies on environmental protection and supervision, and exercise strict supervision.

Zhang Jun is also studying domestic mixed ownership reforms and open policies in the oil and gas sector. He hopes to have the opportunity to enter. After all, state-owned enterprises and private enterprises have their own advantages. Some blocks are not suitable for state-owned enterprises, but they are suitable for private companies.

Communication Backup Lithium Battery System

48V Dc Battery System,Lithium Battery System,Long Cycle Time Battery System,Communication Backup Battery System

Wolong Electric Group Zhejiang Dengta Power Source Co.,Ltd , https://www.wldtbattery.com