As an essential role in smart homes to occupy the living room, at the beginning of the new year, we would like to talk about the performance and trends of smart TV in 2017.

After 3 years of extensive development in 2015-2017, smart TV brands have formed a trend of enveloping. While maintaining the market increase, each major brand is also integrating its own advantages, creating more possibilities and bringing better results to users. Viewing experience. Throughout 2017, although the market as a whole still maintains a growth trend, the smart TV industry can be said to be a twinkling fire.

Affected by the price of LCD panels, 2017 was a cold year for smart TVs, but this year also saw the rise of Internet brands such as Xiaomi and PPTV. This year, LeTV faded out, the OTT industry broke out, the intensive cultivation of the content market, AI technology intervened in the terminal hardware configuration, and the new technology brought about by the laser television division, the smart TV market is also undergoing a huge change.

(For a long time to come, smart TV users will show high growth.)

(users watching TV time increase)

Looking at the data, the audience is returning to the living room, and the time spent on television is gradually increasing. For a long time to come, the living room screen still has a large market demand, and people have a need for viewing experience and a larger screen. It is also getting higher and higher. The resulting “living room economy†is still the direction of future development of major brands. Only the future "living room economy", the major brands still rely on selling TV to make money?

[outbreak of OTT market, or will become the main battlefield for smart TV brands in the future]

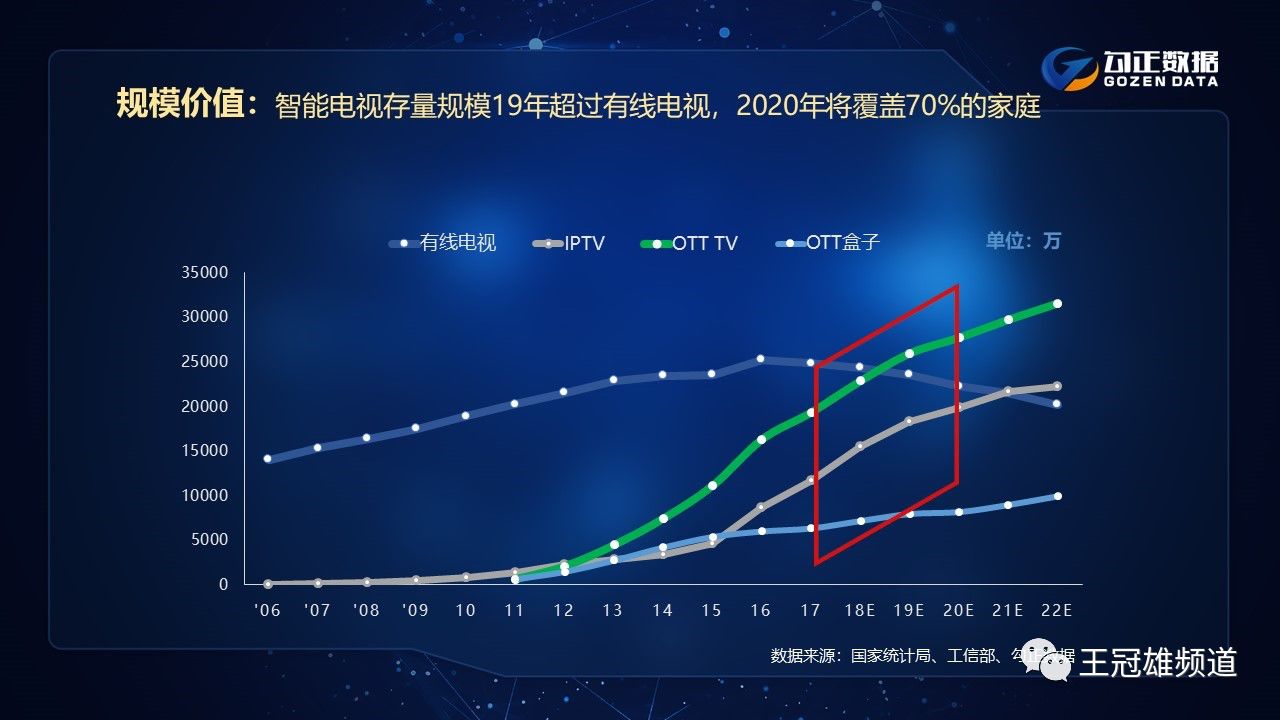

According to the data from the Institute of Speed ​​Research, at the end of 2016, the number of smart TVs reached 146 million, and the coverage rate exceeded 25%. A breakthrough of 25% indicates that Smart TV has a sufficient amount of retention alone as an Internet terminal, representing the upcoming benefits of OTT industry scale advertising. This threshold is an essential change in the smart TV industry. The economic benefits brought by smart TVs in the OTT industry in 2017 also confirmed this.

(Source: Speed ​​Research Institute)

1.8 million a day, 10 million standard, core package volume, single agent over 100 million, average daily operating rate of 46% ... This is a popular vocabulary in the 2017 OTT circle (ie "Over The Top"). The market is hot.

In 2017, OTT advertising revenue reached 2.3 billion yuan, an increase of 130% over the same period of last year, of which the patch was 1.6 billion, up by 70% year-on-year, the startup was 460 million, up 20% year-on-year, and the other 240 million, up 10% year-on-year. The heads of the industry’s heads have entered the OTT, and the brands of cars, fast-discharging, e-commerce, and mobile phones have become the most frequently listed categories on the OTT screen.

In the entire OTT market, start-up advertising is the most obvious category of growth. Due to mandatory viewing, high reach, and customization, boot advertising has become the most popular and costly marketing tool for 80% of OTT advertisers. At the beginning of 2017, the price of TV boot advertising for LeTV has reached 1.8 million/day, which is comparable to the 10 second advertisement before and after the CCTV “News Networkâ€.

The industry believes that boot advertising is a scarce resource and there is not much left in the development space. The game of smart integrated TVs is more diversified, and advertisements are spread over every place where advertisements can appear. This has given rise to the birth of another form of advertising – the market for patch advertisements has begun to break out.

SMD ads are diverse in gameplay, only patch ads, and are also divided into pre-patch, pause-patch, post-patch, etc., as well as novel advertisements such as brand zones, shutdown ads, desktop recommendations, interactive ads, and television e-commerce. Implantation form. This kind of advertisement is mainly provided by such content providers as Youku, iQiyi, Tencent, PPTV, etc., and later divided with OTT licensees and hardware manufacturers.

From an industry perspective, the volume of SMD ad inventory is very large, and the main competitors are still mainstream video sites such as iQIYI, Penguin TV, Youku and others. Each video site generally adopts a multi-screen distribution + OTT-oriented business model to promote OTT ad development competition. In the future, the distribution, diversion, and content placement of OTT's entire desktop will be more valuable. SMD advertising is ushering in a rapid flow of cash.

Therefore, more and more smart TV manufacturers began to shift their focus from hardware to OTT's open cooperation. Xiaomi, Hisense, and Konka have started to expand their business opportunities. In this process, smart TV manufacturers with both hardware terminal and content platform advantages will benefit the most. If Leighton had the most advantage, then after LeTV's "self-mutilation," it would be possible to take over this banner and leave only PPTV.

As a veteran video platform, PPTV has made great strides in its content-based advantages while using Suning as a powerful backing to strengthen its own hardware terminal technology development. In 2017, PPTV Smart TV released the high-end flagship N55, deeply ploughed into the field of smart TV hardware, and developed the original Rubic system to optimize the experience of the terminal system. These were the advantages of PPTV in plugging in the terminal hardware. The establishment of the PPTV smart TV in the OTT market has laid the foundation.

Yin Yu'an, vice president of PPTV smart hardware company, said that how to use existing brand resources to realize cash is now the focus of PPTV. Yin Yu'an introduced that, in terms of content realization, in addition to adopting the most commonly used form of adverts, PPTV continues to update its technology through innovations in technology and products. For example, when users use the ads, they appear in the form of data messages.

This also includes useful information such as teams, tournaments, etc., which can give users guidance on viewing. At the same time, PPTV smart TV also launched a large-screen shopping channel, opened Suning Tesco, really realized at the big screen side to buy and realize the cash model, and this is where PPTV smart TV will focus on the future.

Joining other terminals is also a very important step for PPTV. With its own content platform advantage, it can make up for the lack of content advantages of other smart TV brands, and combine more brands of TVs such as Xiaomi, Philips, Komi, and Konka to gain more traffic and portals, and PPTV can maximize its advantages. In order to occupy the commanding height of the "living room economy".

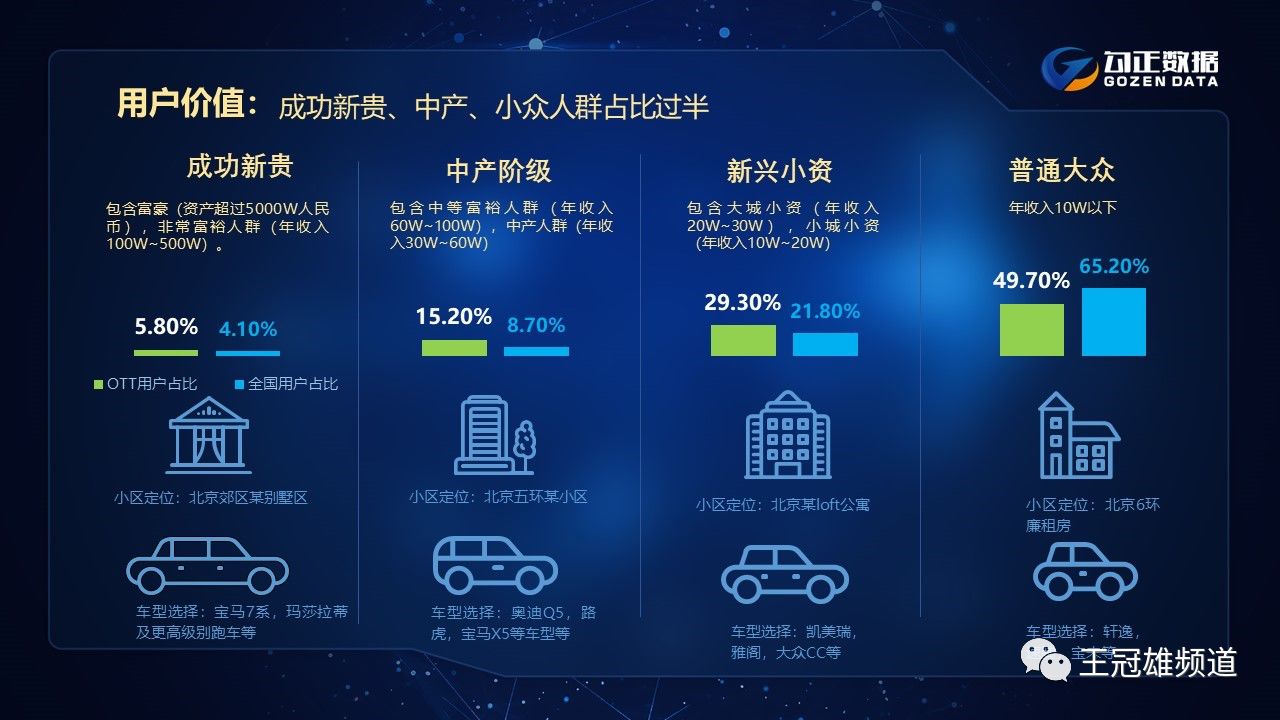

Smart TV users have more advertising reach value. This group of users has strong purchasing power and favors high-end car brands.

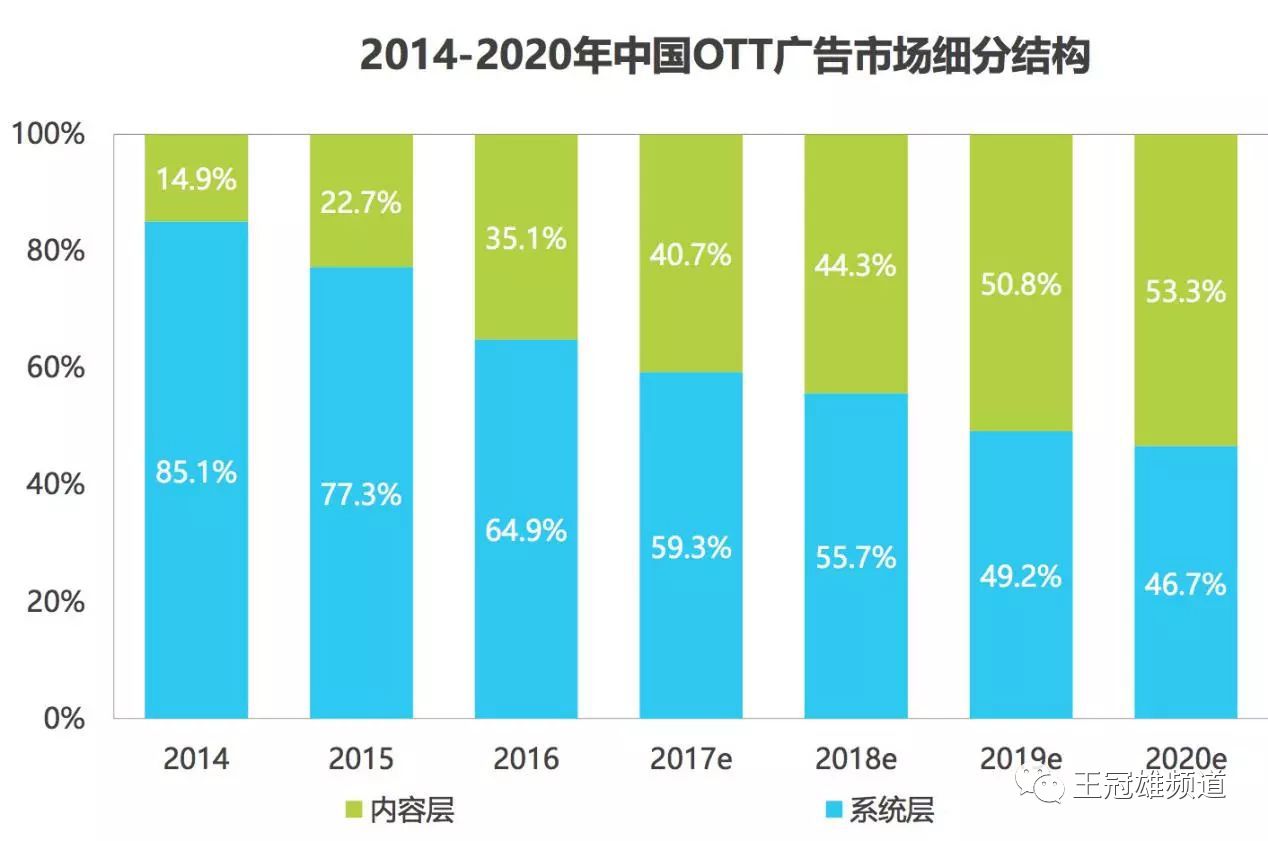

However, the OTT industry is also undergoing differentiation. The differentiation comes from system-level advertisements based on boot-advertising and content-level advertisements mainly including patches and screensavers. Although the proportion of system-level advertisements is still as high as 59.3%, data agencies predict that by 2019, content-based advertising will exceed the system level, and by 2020 it will reach 53.3%.

This differentiation enables all major Internet video platforms, such as Xiaomi, PPTV, and micro-whales, to integrate high-quality content resources through content, copyright, and channels, and to deeply deploy OTT terminal content markets.

According to the OTT Industry Development Report 2017, it is estimated that by 2020, the stock of smart TVs will exceed 280 million units, accounting for nearly 60% of the market; the arrival rate of smart TVs will gradually increase to 70%. Future OTT wars will become increasingly fierce.

[content scramble for war spread, content is still the mainstream]

From the differentiation of the system layer and the content layer, it can be seen that the OTT competition is content competition in the end. Therefore, it can be seen that in 2017, both the video platform and the TV brand have made great efforts to launch exclusive homemade content. Its own unique brand recognition, steady its own head traffic.

After the music was dumped, the copyright market quickly shuffled and re-segregated. Branded TVs cooperated with Internet video giants and traditional TV stations. Among them, Xiaomi TV adopts an open and win-win cooperation model in terms of content, and accesses all contents of iQiyi, Tencent Video, Sohu Video, and PPTV, which greatly enriches the insufficiency of its own content resources.

Microwhale TV directly integrates large-scale content platforms such as Tencent Video and Mango TV through the bottom layer, bringing together huge content resources, including current TVB content, and BBC children's and Hollywood's resource libraries. The PPTV smart TV, which is based on the PPTV video platform itself, has a large number of titles on the head and television dramas, such as “The Name of the People,†“The Hunting Ground,†“The General is on,†“Our Boyhood,†“Our Love,†and so on. Over 400,000+ hours of video and entertainment resources form a powerful, comprehensive, multi-angle, full-category coverage matrix.

Sports content copyright is also the focus of competition. Compared to the film and television variety industry, sports viewing groups have high loyalty and pay to watch habits. Sports content can bring more high-quality traffic and liquidation entrances. As a result, sports content has become a major smart TV landing beach layout. An important part of the content ecology.

In 2017, Tencent signed NBA broadcasting rights. In the headline layout of today's ultrashort video cooperation, iQiyi became the exclusive new media partner for the ATP 2017-2020 in mainland China. In 2017, PPTV won a big win over La Liga and the Premier League. Super League and other top events have historically brought together five major leagues in Europe, taking 90% of domestic and foreign sports events and becoming the largest Internet TV sports content platform in China.

In the “content is king†era of the Internet, the richness of content resources has become an important option for consumers to purchase smart TVs. PPTV smart TV has its own unique advantages, can open up the hardware terminal and content platform, relying solely on this point, the future PPTV in the "living room economy" this battlefield performance can be expected.

ã€Artificial intelligence penetrates home entertainment market】

In fact, the traffic competition in the OTT market is not only content competition but also the end-to-end viewing experience. Today's consumers are increasingly demanding a sense of experience. In order to enhance the product's interactive experience, in the homogenization of the hardware market breakthrough, the major manufacturers have turned their attention to artificial intelligence, seeking to enhance the viewing experience more possibilities.

In 2017, many television brands released their own smart operating systems. The voice recognition system built by millet, micro-whale and PPTV smart TV can search for the film source according to the voice prompts; Changhong TV initially reads the images to find the film source, which greatly improves the viewing experience of smart TV; storm, cool open TV brands such as Popular and Popular have also launched new products for artificial intelligence televisions.

With the accumulation of OTT terminal data and the system's subdivision of people's preferences, operators of Internet TV have begun to place different advertisements for different users. This kind of advertising recommendation model similar to the "Today's Headline" is not only more accurate, but also Minimize user experience impact.

However, at present, the combination of TV and artificial intelligence is still far from expected. Consumer usage is limited, and there are still some problems in user interaction. Although artificial intelligence has injected fresh blood into smart TVs, real AI TVs still have a long way to go. In the future, the development of artificial intelligence televisions will require not only the efforts of TV manufacturers, but also the support of more directions from upstream and downstream industries.

[New Technology Impacts Market, Laser TV Enters Strong]

In 2017, a "new species" that frequently appeared in the smart TV market also attracted my attention - laser television. Hisense, millet, rice, nuts, PPTV are eager to release their new laser television products. Therefore, there are people who say that 2017 is the "laser television first year."

The appearance of laser televisions, with a large screen of 100 inches, has indeed broken through the bottleneck in the size of LCD TVs, and it is also more in line with modern people's infinite desire for large screens, and it has more color reproduction and richness than LCD TVs. degree. According to Ovid data, the sales volume of the domestic laser TV market in the third quarter of 2017 reached 21,000 units, which represented a growth rate of 241% over the same period.

When the LCD TV market is just about to mature, the laser TV will enter the market strongly and there will be great subversion. Some people say that laser TV is the next form of LCD TV. However, the domestic laser TV market is still in its infancy, and issues such as brightness, color uniformity, and viewing experience have not been well resolved, and product standards are also uneven. Whether it can really replace smart TV may not be a short-term thing, we will wait and see.

[Conclusion]

Overall, 2017 can be described as “the year in which the living room economy has landed.†Some people had predicted that 2017 will be the critical year for the OTT outbreak. This prediction seems to have come true. Smart TV will still have a large update demand in the next three years. With the continued expansion of the possession of smart TVs, it will provide the basis for the realization of content and operational realities. It is expected that the size of China's living room economy market will reach RMB 230 billion in the future.

How to seize the high ground of the living room economy will be the main topic of the smart TV industry in the future. The war has only just begun.