In the automotive electronics market, we must talk about the world's top automotive electronic chip manufacturer-Infineon, the product line covers sensors, microprocessors and actuators. Infineon's power device global market share has been the first for 11 consecutive years. Over 1/2 of the load in every new car in the world is driven by Infineon's automotive power devices. Infineon is the world's largest supplier of IGBT modules. 50% of new cars produced worldwide use Infineon 32-bit microcontrollers.

According to a report by the authoritative organization Strategic AnalyTIcs, Infineon Automotive Electronics ranked first in the Asia-Pacific market in 2012 with a sales value of 538M USD (market share 9.4%). Excluding the in-vehicle infotainment system market, Infineon has a market share of 12.2%, and the market share of the second and third manufacturers is 10.8% and 9.2%, respectively.

However, do you really understand and grasp the latest opportunities in the entire major components and markets of automotive electronics? The electronic enthusiast network will discuss with you in depth.

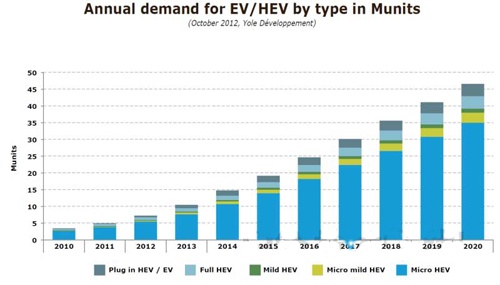

2010-2020 Global HEV / EV Market Demand Trend

Automotive changes power device technology and market

The rapidly changing alternative energy market has caused turbulence in the power electronics business that has been very stable in the past. The huge potential market size of hybrid electric vehicles (HEV) and pure electric vehicles (EV) may also bring further changes in this field, because HEV and EV need technologies that can handle more power and higher heat. Its potential market size attracts new entrants with various business models, so more new technologies will appear and costs are estimated to be reduced.

The size of the power module packaging market is currently about 800 million US dollars, and will continue to grow steadily in the future. The current size of the power device market is 2.9 billion US dollars and is expected to grow to 4.2 billion US dollars in the next five years. High-power semiconductors have been growing steadily at an annual growth rate of 4-6%. However, in 2012, sales dropped to 20-25%. The reasons for this include the sharp reduction in demand for wind power and electrified trains in China, the cessation of government encouragement policies for photovoltaic power generation in countries around the world, and the reduction in factory investment due to economic downturn. The decline in sales of high-power semiconductors is caused by a variety of accidental unfavorable factors, so it will return to a steady growth track of 4-6% annual growth rate in the future.

As the proportion of HEV and EV products in this market will increase, the market may change dramatically in the future. Sales of power modules for HEVs and EVs will reach US $ 2.5 billion by 2020, accounting for about half of the market. Shipments for this purpose will be equally shared with consumer product uses for the first time. For existing semiconductor suppliers and assembly companies, business for automotive applications may become more attractive.

The HEV and EV markets will put forward new technical requirements for power electronic devices, such as expanding the operating temperature range and circulation range, reducing the size, and improving the cooling capacity. Large companies engaged in the automotive, power device and materials businesses have begun to make huge investments, but it is unclear how and by whom this device will be packaged.

The key lies in the IGBT (insulated gate bipolar transistor) device. At present, the major manufacturers basically carry out module packaging and assembly operations by themselves, or use one of the few module assemblers. The largest module suppliers-Semikron (Semikron) and Danfoss (Danfoss) have also made huge development investments, and highly specialized assembly operations are basically carried out in Europe.

Affected by the photovoltaic power generation and wind energy bubbles, many new companies have emerged in Asia, including China's fabless and light factory power device manufacturers. These manufacturers use the newly emerging numerous chip foundries and module assemblers to produce their own products, and are currently exploring new markets.

The key issue in the power semiconductor sector is the cause of stripping—the mismatch between thermal cycling and thermal expansion. These issues have inspired research on die bonding techniques that are superior to wire bonding, new materials used to mount the die, and direct bonding of copper substrates.

In terms of replacing aluminum wire bonding, copper wire bonding should be the most powerful candidate technology. This technology has been fully recognized in the field of reducing resistance by thinning wires, increasing thermal conductivity and extending product life. But in fact, it is extremely difficult to mass-produce thin wires and small pads with high yield because the metallization of the die that prevents copper contamination is difficult to achieve.

Aluminum ribbon bonding technology has been adopted by mass production lines. Although this technology can extend the thermal cycle life through large pads, it has no obvious effect on improving resistance and thermal conductivity, and the cost is very high. Another candidate technology close to practical level is the sintering technology using silver particles, which can be used in copper polyimide foil or aluminum bonding tape, which is expected to greatly extend the life of the product while maintaining electrical resistance and thermal conductivity.

In addition, in order to achieve more excellent heat resistance cycle characteristics, the traditional solder used in die welding is gradually being replaced by high-temperature substitutes. Eutectic solders using copper and tin have been used by Infineon for production. A very thin tin layer and a copper layer overlap together. After being heated, the tin layer melts and diffuses into the copper layer, so that an alloy with a high melting point can be formed.

Semikron is currently advancing sintering technology using ultra-fine silver powder paste. This technology can greatly extend the thermal cycle life, but requires a process that can maintain heat and pressure evenly, which is time-consuming and cumbersome. The sintering technology using nano-silver particles requires lower temperature and pressure, which can shorten the processing time, but the problem is that the silver particles will move at high temperature, and the raw material cost is high.

To achieve better thermal performance at the substrate level, one of the methods is to replace the ceramic material used in the directly bonded copper substrate from Al2O3 or Si3N4 to AlN (aluminum nitride), but this method will lead to a further increase in cost. A more effective method is to remove the ceramic substrate and directly coat the copper foil on the heat sink to increase the direct cooling area.

waka

Hongkong Onice Limited , https://www.osbvapepen.com